Get Uniform Cost Sharing Plan, Cop Cost-share Worksheet 3, F-29322 - Dhs Wisconsin

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Uniform Cost Sharing Plan, COP Cost-Share Worksheet 3, F-29322 - Dhs Wisconsin online

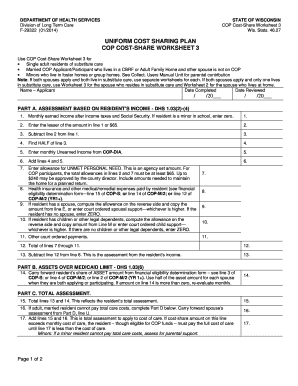

The Uniform Cost Sharing Plan, COP Cost-Share Worksheet 3, F-29322, is essential for determining cost-sharing responsibilities for individuals in various care settings in Wisconsin. This guide provides clear, step-by-step instructions on completing the form online to ensure accuracy and efficiency.

Follow the steps to fill out the COP Cost-Share Worksheet 3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the applicant's name and the date the form is completed in the designated fields.

- Complete Part A by assessing the resident's income. Start by providing the monthly earned income after taxes and Social Security, noting that if the resident is a minor in school, this amount should be entered as zero.

- In line 2, enter the lesser amount from line 1 or $65.

- Subtract line 2 from line 1; enter the result on line 3.

- Calculate half of the amount from line 3 and enter it on line 4.

- On line 5, input the monthly unearned income from COP-DIA.

- Add the amounts from lines 4 and 5 and place the total on line 6.

- Enter the allowance for unmet personal needs on line 7, which is an agency-defined amount, ensuring that the total of lines 2 and 7 is at least $65.

- Record health insurance and other medical expenses on line 8 based on previous forms.

- If the resident has a spouse, input the allowed amount on line 9 based on either the computed allowance or court-ordered spousal support—enter zero if there is no spouse.

- On line 10, input amounts related to children or other legal dependents; enter zero if none exist.

- Document any other court-ordered payments on line 11.

- Total lines 7 through 11 and enter the result on line 12.

- Subtract line 12 from line 6; this will reflect the assessment from the resident's income on line 13.

- Proceed to Part B and carry forward the resident’s asset amount from the financial eligibility determination form on line 14.

- In Part C, total lines 13 and 14 on line 15 to reflect the resident’s total assessment. If necessary, complete Part D for further cost-share details.

- Finalize the form by reviewing all entries, making necessary corrections, and then save changes, download, print, or share the form as needed.

Complete your COP Cost-Share Worksheet 3 online today to ensure a smooth and accurate submission.

Your cost share amount is based on several factors including your gross income, marital status, living arrangement and other allowable Medicaid credits. The Income Maintenance office will determine the amount of your cost share. Highlighting information about cost share for enrolling in Family Care or ... wisconsin.gov https://.dhs.wisconsin.gov › publications wisconsin.gov https://.dhs.wisconsin.gov › publications

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.