Get Mileage Report Continuation Sheet - Oregon Department Of ... - Odot State Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Mileage Report Continuation Sheet - Oregon Department Of Transportation online

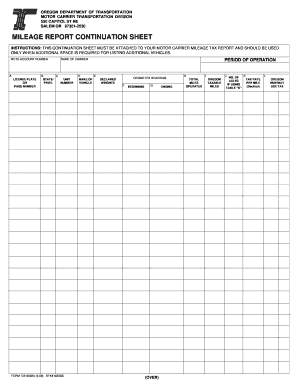

Filling out the Mileage Report Continuation Sheet is essential for motor carriers required to report additional vehicle mileage. This guide provides clear instructions to help you accurately complete the form online, ensuring compliance with Oregon Department of Transportation's requirements.

Follow the steps to complete the Mileage Report Continuation Sheet online.

- Press the ‘Get Form’ button to access the Mileage Report Continuation Sheet, which will open it in your preferred online editing tool.

- In section A, input your Motor Carrier Transportation Division (MCTD) account number.

- In section B, enter the license plate or pass number of the vehicle for which you are reporting mileage.

- Complete section C with the name of the carrier associated with the reported vehicle.

- In section D, provide the state's abbreviation or unit province number related to your vehicle.

- Section E requires you to input the make of the vehicle you are reporting.

- In section F, state the period of operation for which you are reporting this mileage.

- Fill out section G with the beginning odometer reading for the reported period.

- Input the ending odometer reading in section H.

- Calculate the total miles operated for the reporting period and write that number in section I.

- In section J, indicate the number of axles the vehicle has.

- Enter the tax rate per mile, as described in the table, in section K.

- Calculate the Oregon highway use tax based on your reported mileage and fill it out in section L.

- Once you have completed all sections, review the information for accuracy. Save your changes and download, print, or share the completed form as necessary.

Complete your Mileage Report Continuation Sheet online today for accurate reporting and compliance.

Filling out a mileage sheet requires you to note the dates, starting points, destinations, and total miles driven. Ensure that each trip is documented accurately to reflect your travel for reporting purposes. The Mileage Report Continuation Sheet - Oregon Department Of ... - Odot State Or simplifies this process, guiding you step-by-step to avoid common mistakes. Accurate completion guarantees a smooth process for tax assessment and reimbursement.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.