Loading

Get State Tax Registration Application - The Payroll Center

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Tax Registration Application - The Payroll Center online

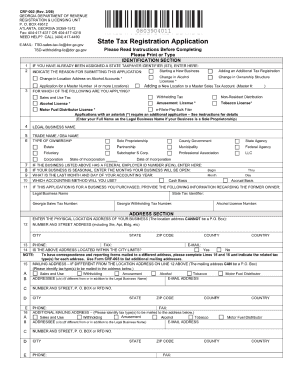

Filling out the State Tax Registration Application - The Payroll Center is an essential step for employers who wish to comply with state tax obligations. This guide will assist you through the process of completing this application online, ensuring that you provide accurate and relevant information.

Follow the steps to successfully complete your state tax registration application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business name in the designated field. Ensure that the name matches what is on your official business registration documents.

- Provide your business address, including street name, city, state, and zip code. Make sure all information is current and correctly formatted.

- Indicate the type of entity you are registering (e.g., corporation, partnership, sole proprietorship) by selecting the appropriate option from the list.

- Enter the federal employer identification number (FEIN) if applicable. If you do not have one, check the box stating so. This number is crucial for tax identification.

- Include the contact information for the primary contact person. This should be a representative who can respond to queries regarding the application.

- Review the sections related to specific tax liabilities you wish to register for, such as unemployment insurance or withholding tax, and ensure you make corresponding selections.

- Double-check all entries for accuracy and completeness before submitting the application. Errors can delay processing times.

- Finally, save your changes. You may also download, print, or share the completed form for your records.

Take the next step towards compliance — complete your State Tax Registration Application online today.

Creating a payroll register involves tracking employee work hours, wages, and deductions. You can use the State Tax Registration Application - The Payroll Center to simplify this process by ensuring accurate tax calculations and compliance. Regularly update the register with each payroll period to maintain clear records and facilitate audits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.