Get Form 8849 (schedule 2) - Internal Revenue Service - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8849 (Schedule 2) - Internal Revenue Service - Irs online

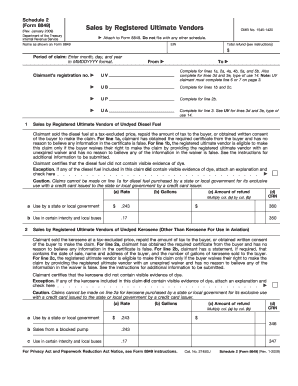

Filing Form 8849 (Schedule 2) is essential for registered ultimate vendors who seek a refund on specific fuel sales. This guide provides clear and straightforward instructions to help users complete the form efficiently and accurately online.

Follow the steps to complete Form 8849 (Schedule 2) online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter your name as shown on Form 8849 in the designated field.

- Input your Employer Identification Number (EIN) in the respective section.

- Calculate the total refund by summing all amounts claimed in column (c) and enter this figure in the total refund box at the top of the schedule.

- Specify the period of your claim by entering the start and end dates in MMDDYYYY format.

- For each applicable line, complete sections according to the type of fuel sold (e.g., undyed diesel, kerosene, gasoline) as instructed in the form.

- Include the necessary certifications and waivers as required, ensuring that all claims meet the minimum thresholds for filing.

- If additional space is needed, attach supplemental sheets for detailing governmental units or nonprofit organizations as specified in the instructions.

- Review all entries for accuracy and completeness, ensuring all required fields and calculations are filled out correctly.

- Once finalized, save changes, download, print, or share the completed form as needed.

Start filling out your Form 8849 (Schedule 2) online today!

Schedule 2 on Form 1040 is used to report additional taxes owed, which may include any adjustments related to excise taxes. Although it might seem indirect, it contributes to your overall tax obligations when using fuels. Properly managing these forms, including Form 8849 (Schedule 2) - Internal Revenue Service - Irs, ensures that your tax return accurately reflects your financial situation. Connecting with a competent tax service can help clarify your obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.