Loading

Get F4506a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F4506-A Form online

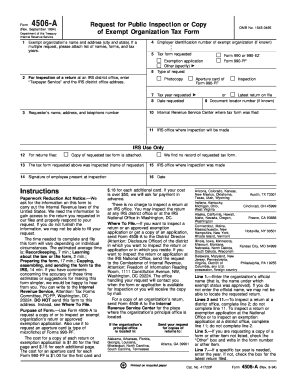

The F4506-A Form is used to request a copy or to inspect an exempt organization's tax return or exemption application. This guide will help you fill out the form online with clear, step-by-step instructions, ensuring you complete your request accurately and efficiently.

Follow the steps to fill out the F4506-A Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the exempt organization’s name and address. Ensure you include the official name under which the organization was granted tax-exempt status.

- Provide your name, address, and telephone number in the requester’s section.

- For inspection requests at an IRS district office, fill in line 2 with 'Taxpayer Service' and the respective address. If you are requesting inspection at the National Office, complete line 11 instead.

- Select the type of tax form you are requesting in line 5. Options include Form 990, Form 990-EZ, Form 990-PF, or specify if it is an exemption application.

- Indicate the tax year you are interested in by completing line 7. If you need the latest return filed, check the appropriate box.

- If applicable, provide the document locator number in line 9.

- Finally, review all entered information for accuracy and completeness before saving your form.

- You can then download, print, or share the completed form as needed.

Complete your request for documents online today!

When the IRS receives a request for verification of non-filing using the F4506a Form, it indicates that an individual is affirming they did not file a tax return for a specific year. This verification can be essential for certain financial applications or government benefits. Using the F4506a Form, you can easily demonstrate your tax history and non-filing status as needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.