Get Sample Protective Claim For Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Protective Claim For Refund online

Filling out the Sample Protective Claim For Refund is essential for individuals who wish to safeguard their rights to a tax refund related to disputes with the IRS. This guide provides clear, step-by-step instructions on each section of the form to ensure a smooth online submission process.

Follow the steps to successfully complete your claim.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

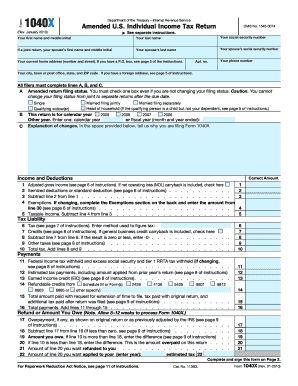

- Fill in your personal information at the top of the form, including your first name, middle initial, last name, and social security number. If applicable, include your spouse’s information.

- Indicate your current address. This should include your street number, city, state, and ZIP code.

- Select your amended return filing status by checking the appropriate box. Note that your filing status cannot be changed from joint to separate returns after the due date.

- Specify the year for which you are filing the claim by checking '2007' under the calendar year section.

- In the explanation of changes section, briefly describe the reasons for submitting the protective claim for refund in the space provided.

- Complete the income and deductions section with the correct amounts, including your adjusted gross income and the appropriate deductions.

- Calculate your total tax liability and payments. Include any items such as federal income tax withheld and estimated tax payments.

- Determine whether you have an overpayment or an amount owed. If you have an overpayment, specify the amount you wish refunded to you.

- Complete and sign the form. Ensure you date your signature appropriately. If filing jointly, your partner must also sign.

- After reviewing the completed form for accuracy, save your changes, download it for your records, and prepare it for filing.

Begin filing your protective claim online today to secure your potential tax refund.

To claim for a refund and request for abatement, you must submit separate forms to the relevant tax authority. Start with the refund form that documents your overpayment and then complete an abatement request if you believe penalties or interest charges should be reduced. Using a Sample Protective Claim For Refund can streamline this process and help you ensure that your documentation is complete. Platforms like US Legal Forms offer templates and guidance that simplify these procedures, making the process easier for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.