Loading

Get Nys 209 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys 209 Fillable Form online

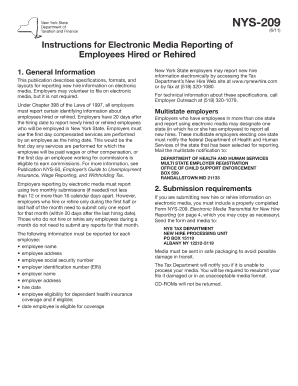

Filling out the Nys 209 Fillable Form electronically is a straightforward process designed to assist users in reporting new hire information accurately. This guide provides step-by-step instructions to help users complete the form online with ease.

Follow the steps to complete the Nys 209 Fillable Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the transmitter information, including the transmitter's name and employer identification number (EIN). Make sure to fill in the street address, city, state, and ZIP code accurately.

- Fill out the contact information for a technical person who can be reached regarding the electronic media. Include their name, telephone number, and ensure that all fields are clearly indicated.

- Move on to the CD-ROM data section. Enter the total number of employer records being reported and the total number of employee records reported. Make sure to include the last day of the reporting period.

- For multiple employer records, enter each EIN and corresponding employer name. If necessary, attach additional sheets to accommodate all employers.

- Once all relevant sections are filled out, review the entire form for accuracy and completeness. Check for any missing information or errors.

- Finally, save the changes you made to the digital form. You may download, print, or share the filled form as necessary.

Complete your electronic forms online today for efficient and accurate reporting.

Yes, you can absolutely paper file your NYS tax return. The NYS 209 Fillable Form makes this process easier by allowing you to fill out your information before printing. While e-filing can streamline submissions, many taxpayers still feel comfortable using paper. Be sure to keep updated on deadlines to ensure timely filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.