Loading

Get Irs Cawr

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Cawr online

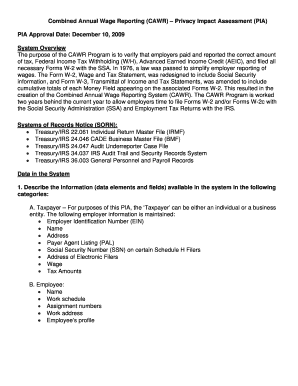

The Irs Cawr, or Combined Annual Wage Reporting form, is essential for employers to accurately report wage and tax information. This guide provides clear, user-friendly steps to help you complete the form online with ease.

Follow the steps to fill out the Irs Cawr online effectively.

- Press the ‘Get Form’ button to access the Irs Cawr form and open it in your preferred digital format.

- Begin by entering your Employer Identification Number (EIN) in the designated field. This unique identifier is crucial for IRS processing.

- Fill in your organization’s name and address accurately. Ensure that all information matches your official records to avoid processing delays.

- If applicable, provide the Social Security Number (SSN) for employees who are relevant to certain Schedule H filings.

- Enter the wage amounts and tax figures that correspond to each employee. Make certain that these figures are precise, as they will be used for tax assessment.

- Review the Payer Agent Listing (PAL) if necessary and ensure it is complete and accurate.

- Once all fields are filled out, go through each entry to verify its accuracy. Look for misspellings or incorrect figures that could lead to issues.

- After confirming that all data is correct, you can proceed to save your changes, download the form, print it for your records, or share it as needed.

Complete your Irs Cawr form online today to ensure timely reporting and compliance.

After receiving a CP503, you may get a CP504 or other collection notices from the IRS if the balance remains unpaid. These subsequent notices increase urgency and may indicate potential enforcement actions. It is vital to address the situation promptly to avoid additional complications. To help navigate this process, consider using USLegalForms and gather information about IRS CAWR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.