Loading

Get W7a

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W7a online

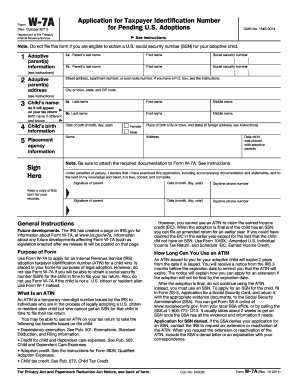

Filling out the W7a form is an essential step for adoptive parents seeking a taxpayer identification number for their child during the adoption process. This guide provides clear instructions to help users navigate each section of the W7a form effectively.

Follow the steps to complete the W7a form online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the adoptive parent(s) information in Section 1. Provide the last name, first name, and social security number of each parent. Ensure the names are entered in the order they appear on your tax return.

- In Section 2, fill in the adoptive parent(s) address details, including street address, city, state, and ZIP code. If you have a P.O. box, enter that information as instructed.

- Go to Section 3 to enter the child's name. Fill in the last name as it will appear on your tax return and, if applicable, the birth name in the provided field.

- In Section 4, document the child's birth information. Input the date of birth and the child's place of birth, along with their sex.

- Section 5 pertains to the placement agency's information. Provide the name and address of the agency that placed the child with you, as well as the date of placement.

- Make sure to sign and date the application at the bottom of the form. If applicable, the co-adoptive parent must also sign.

- Review all information for accuracy and completeness. Be sure to attach any required documentation to support the application.

- Finally, save your changes, download, print, or share the completed W7a form as needed.

Start completing your W7a form online today to ensure a smooth adoption process.

Filing a conso file involves consolidating your data into a single report, which can be crucial for tax reporting and compliance. Begin by organizing all relevant financial information and ensure accuracy in your data collection. You might find platforms like US Legal Forms useful for templates and guidance to help you file your conso file correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.