Loading

Get Eic For 2001 Form 1040

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EIC For 2001 Form 1040 online

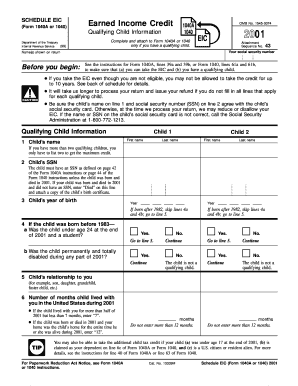

Completing the EIC For 2001 Form 1040 is an essential step for those eligible for the earned income credit. This guide provides clear and detailed instructions to help you fill out the form accurately and efficiently, ensuring you maximize your credit.

Follow the steps to fill out the form online effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your social security number and the name(s) displayed on your tax return. Verify this information against your documents to ensure accuracy.

- On line 1, list the name of your qualifying child. Ensure the child’s name matches the information on their social security card.

- For line 2, input the child’s social security number. If your child was born and died in 2001 without a SSN, write ‘Died’ and attach a copy of the birth certificate.

- On line 3, document the child’s year of birth. If born after 1982, skip lines 4a and 4b, proceeding to line 5.

- For lines 4a and 4b, if your child was born before 1983, answer whether they were under age 24 and a student, and if they were permanently and totally disabled during any part of 2001.

- On line 5, describe the child’s relationship to you, using terms like son, daughter, or foster child.

- Enter the number of months the child lived with you in the United States during 2001 on line 6. Ensure that the months entered do not exceed 12.

- Review all entries to ensure accuracy, as any discrepancies may delay processing or reduce your EIC.

- After completing the form, save your changes and prepare to download, print, or share the form as needed.

Complete your EIC For 2001 Form 1040 online to ensure you receive the credits you deserve.

Eligibility for the EIC depends on several factors, including your filing status, earned income level, and the number of qualifying children you have. To qualify for the 2001 EIC, your income must fall within specified limits based on your household composition. Reviewing the eligibility guidelines thoroughly will help you determine if you can take advantage of this credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.