Loading

Get Guide To Understanding Your W - 2 - Office Of The Auditor-controller - Auditorcontroller

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guide To Understanding Your W - 2 - Office Of The Auditor-Controller - Auditorcontroller online

This guide provides a comprehensive overview of how to fill out the Guide To Understanding Your W - 2 - Office Of The Auditor-Controller - Auditorcontroller online. Users will receive step-by-step instructions for each section and field of the form.

Follow the steps to successfully complete your W - 2 form.

- Click the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by reviewing the introduction section of the form, which outlines its purpose and importance. Ensure that you have all necessary documents and information at hand.

- Locate the personal information section, where you will provide your full name, address, and social security number. Double-check that all entries are accurate, as this information is crucial.

- In the income section, enter the total wages you earned during the tax year as shown on your earnings statements. If applicable, include any other compensations, such as bonuses.

- Fill out the tax withholdings section accurately, detailing the federal, state, and local taxes that have been deducted from your paychecks throughout the year.

- Review any additional sections that may pertain to specific tax credits or deductions you are eligible for. Input the required information as prompted.

- Once all sections are completed, take a moment to review the entire form for any errors or omissions. Ensure that all information is correct and clearly presented.

- After confirming the accuracy of your entries, save the changes you made. You can then choose to download, print, or share the completed form as needed.

Start filling out your W - 2 form online today!

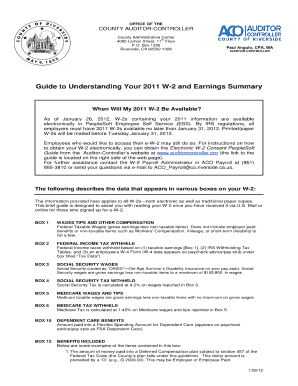

To read and understand your W-2 form, first identify the personal information at the top, then check the earned wages and withheld taxes. Each section is designed to provide specific information necessary for filing your taxes. Delving into the Guide To Understanding Your W - 2 - Office Of The Auditor-Controller - Auditorcontroller will help clarify any uncertainties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.