Loading

Get Form W 7 Rev January 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-7 Rev January 2011 online

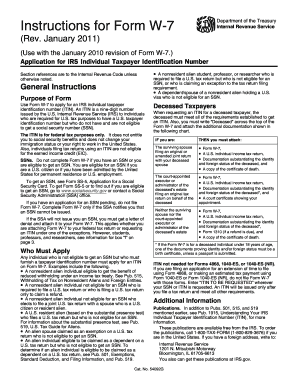

Filling out the Form W-7 Rev January 2011 is a crucial step for individuals who need an Individual Taxpayer Identification Number (ITIN) but are not eligible for a Social Security Number (SSN). This guide provides clear, step-by-step instructions to help you complete the form online efficiently.

Follow the steps to fill out Form W-7 online.

- Click ‘Get Form’ button to obtain the form and access it in the designated digital editor.

- Fill in your legal name as it appears on your documents in line 1a. This will form the basis for your ITIN.

- Complete line 1b with your name as it appears on your birth certificate, if different from line 1a.

- Provide your mailing address in line 2. This is where the IRS will send any correspondence and your original documents.

- Enter your complete foreign address, if applicable, in line 3. If you have moved to the U.S. recently, just state the foreign country.

- Indicate your birth country in line 4. This must be recognized as a foreign country by the U.S. Department of State.

- List your citizenship countries in line 6a. Do not abbreviate the country names.

- If you have a foreign tax identification number, input this on line 6b.

- Complete section regarding your visa status if applicable, including the visa type and expiration date in lines 6c and 6d.

- Choose the appropriate reason for applying in the designated section and check the corresponding box.

- Gather required documentation to support your application and attach it as specified.

- Review the completed form to ensure all information is accurate and comprehensive.

- Save your changes, download the filled form, and print or share it as necessary.

Complete your Form W-7 online today to ensure you get your ITIN smoothly.

You can obtain the Form W 7 Rev January 2011 from the IRS website or by visiting tax assistance centers. Additionally, platforms like uslegalforms provide downloadable templates and instructions that can simplify your application process. Accessing these resources can be a helpful step towards securing your ITIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.