Loading

Get Form 8862 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8862 2009 online

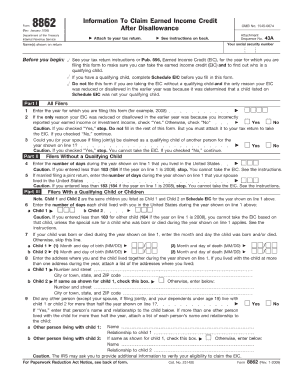

Filling out Form 8862 for the year 2009 can seem daunting, but with the right guidance, it becomes a manageable task. This form is essential for individuals who need to reestablish their eligibility for the earned income credit after it has been disallowed in previous years.

Follow the steps to accurately complete Form 8862 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Once you have the form open, proceed to fill in your personal information in the designated fields. This includes your name, address, and Social Security number. Ensure that all details are accurate and match your official documents.

- In the next section, you will be required to answer questions that pertain to your eligibility for the earned income credit. Take your time to read each question carefully and provide truthful responses.

- Continue to the section where you will need to provide information regarding your qualifying children, if applicable. Fill in their names, Social Security numbers, and other required details for validation.

- Review all the information you have entered for accuracy before moving on. Check for any potential errors or omissions to ensure that your form is complete.

- Once you are satisfied with the accuracy of the information, save your changes. After saving, you have the option to download, print, or share the completed form as necessary.

Start your document process now by filling out Form 8862 online.

Submitting Form 8862 2009 can significantly impact your tax refund by allowing you to claim your earned income credit again. If successfully processed, this form may increase the size of your refund. Therefore, it is essential to complete the form correctly and include all necessary information to ensure a smooth processing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.