Get Form P-1 1999-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form P-1 online

How to fill out and sign Form P-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

While submitting legal documents is generally a demanding and monotonous task, there is a chance to complete them effortlessly by utilizing the US Legal Forms service. It provides the Form P-1 and assists throughout the entire process, ensuring you feel assured in its thorough completion.

Follow the instructions to fill out Form P-1:

Complete Form P-1 on US Legal Forms even while on the move and from any device.

- Initiate the document using the feature-rich online editor to start filling it out.

- Observe the green arrow on the left side of the page. It will indicate the fields you need to complete with a label Fill.

- Once you input the necessary information, the label on the green arrow will modify to Next. When you click it, you will be directed to another fillable field. This will guarantee that you do not overlook any sections.

- Sign the document using the e-signing tool. You can draw, type, or scan your signature, whichever you prefer.

- Click on Date to enter the current date on the Form P-1. It will likely be done automatically.

- Optionally review the suggestions and hints to ensure you haven't overlooked anything and verify the template.

- If you have finished filling out the form, select Done.

- Save the document to your device.

How to modify Get Form P-1 1999: personalize forms digitally

Authorize and disseminate Get Form P-1 1999 along with any additional professional and personal documents on the internet without squandering time and resources on printing and courier services. Maximize our online form editor featuring a built-in compliant electronic signature capability.

Authorizing and submitting Get Form P-1 1999 documents digitally is quicker and more efficient than handling them on paper. Nevertheless, it necessitates the use of online solutions that assure a high degree of data protection and equip you with a compliant tool for generating electronic signatures. Our robust online editor is precisely what you need to finalize your Get Form P-1 1999 and other personal and business or tax forms accurately and appropriately in accordance with all stipulations. It provides all the essential tools to swiftly and effortlessly complete, modify, and endorse documents online and incorporate Signature fields for additional parties, specifying who and where should affix their signatures.

It takes just a few straightforward steps to complete and sign Get Form P-1 1999 online:

When authorizing Get Form P-1 1999 with our comprehensive online solution, you can always rest assured that it will be legally binding and admissible in court. Prepare and submit documents in the most advantageous manner possible!

- Open the selected file for further processing.

- Utilize the upper toolbar to add Text, Initials, Image, Check, and Cross marks to your template.

- Highlight the most important details and blackout or eliminate the sensitive ones if needed.

- Click on the Sign option above and select how you wish to eSign your document.

- Draw your signature, type it, upload its image, or choose an alternative method that suits you.

- Proceed to the Edit Fillable Fields panel and place Signature fields for others.

- Click on Add Signer and enter your recipient’s email to allocate this field to them.

- Ensure that all information submitted is complete and accurate before you click Done.

- Share your documents with others using one of the available options.

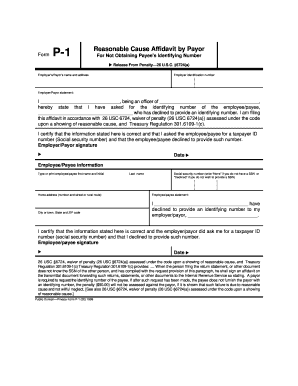

The P 1 form, or Form P-1, serves various purposes within tax submissions or requests. This form collects essential information necessary for the IRS to process certain claims effectively. It’s important to be precise when filling out the P 1 form to avoid processing delays. For optimal completion, consider exploring the supports offered by USLegalForms to guide you through the documentation process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.