Get Connecticut Non-foreign Affidavit Under Irc 1445

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Connecticut Non-Foreign Affidavit Under IRC 1445 online

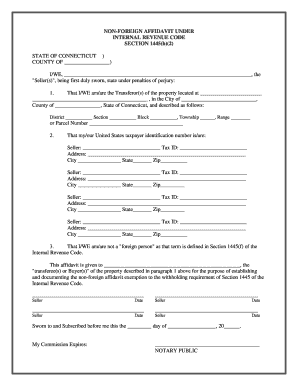

The Connecticut Non-Foreign Affidavit Under IRC 1445 is an essential document for sellers who are not considered foreign persons under the Internal Revenue Code. This guide provides you with a user-friendly approach to accurately completing this affidavit online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the names of the seller(s) in the space provided. Ensure that all parties involved in the property transfer are listed accurately.

- In the first paragraph, specify the location of the property being sold. You will need to provide the city, county, and detailed property description including the district, section, block, township, and range if applicable.

- List the United States taxpayer identification numbers for each seller. This may include social security numbers or employer identification numbers, as applicable.

- Complete the address details for each seller, including street address, city, state, and zip code. Be sure to double-check for accuracy.

- Indicate the knowledge of the sellers regarding their non-foreign status by confirming that they are not considered foreign persons under Section 1445(f) of the Internal Revenue Code.

- Fill out the name of the transferee or buyer for whom the affidavit is being provided. This shows the recipient of the affidavit.

- Ensure that all sellers sign and date the affidavit where indicated. Each seller must provide an individual signature.

- Lastly, the affidavit must be notarized. This involves signing in the presence of a notary public who will complete the necessary certification.

- Once all sections are filled, review the information for accuracy. You can then save your changes, download the completed document, print it, or share it as needed.

Complete your documents online confidently and ensure compliance with tax regulations.

To avoid FIRPTA tax, one effective method is to obtain a Connecticut Non-Foreign Affidavit Under IRC 1445 from the seller. This affidavit allows the buyer to certify that the seller is not a foreign entity, thus exempting them from withholding obligations. Additionally, ensuring that your real estate transactions comply with federal laws can prevent unnecessary tax penalties. Seeking guidance from the experts at USLegalForms can further enhance your understanding and minimize tax liabilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.