Loading

Get Iowa Promissory Note

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Promissory Note online

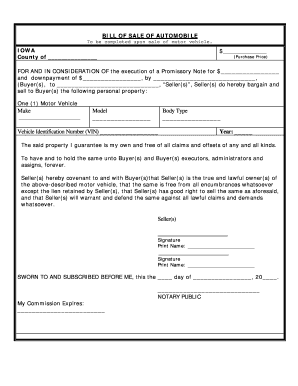

The Iowa Promissory Note is an important document commonly used in the sale of a motor vehicle. This guide will provide you with clear and concise instructions on how to fill out the form online, ensuring that you understand each component and its significance.

Follow the steps to accurately complete the Iowa Promissory Note.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date at the top of the form. This date should reflect when the agreement is made.

- Fill in the names and addresses of both the Buyer(s) and Seller(s) in the designated fields.

- Indicate the purchase price of the vehicle in the specified field. Ensure the amount is accurate and reflects what was agreed upon.

- In the ‘Payment Terms’ section, specify whether there will be interest on the amount financed and at what rate, if applicable.

- Outline the payment schedule by stating the monthly installment amount and the date of the first payment.

- Include a clause regarding any penalties for late payments, if desired, and highlight the rights of repossession available to the Seller in case of default.

- Acknowledge the vehicle’s details by filling in the Make, Model, Year, and Vehicle Identification Number (VIN) of the automobile being sold.

- Conclude the form by having all Buyers sign and print their names in the appropriate sections.

- Finally, review the entire form for accuracy, save your changes, and then choose to download, print, or share the completed document.

Complete your documents online today for a seamless process!

Related links form

To claim on an Iowa promissory note, ensure that you have a copy of the document and any evidence of payment history. Begin by reaching out to the borrower to discuss the outstanding amount. If necessary, you might consider hiring a legal professional to help enforce the terms of the note and claim the owed funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.