Loading

Get Wyoming Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wyoming Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check online

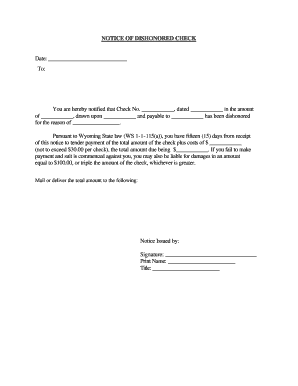

The Wyoming Notice Of Dishonored Check is a crucial document for notifying an individual of a bounced check. This guide will provide clear, step-by-step instructions to complete this form effectively, ensuring you understand each component.

Follow the steps to complete the notice accurately.

- Click ‘Get Form’ button to access the Wyoming Notice Of Dishonored Check and open it for editing.

- Fill in the date at the top of the form. This indicates when the notice is being issued.

- In the 'To:' section, provide the name of the individual to whom the notice is addressed.

- Write the check number in the designated field labeled 'Check No.' This number can usually be found at the top right of the check.

- Enter the date on which the check was issued in the section labeled 'dated.'

- Fill in the amount of the check in the 'amount' field.

- Indicate the name of the bank or financial institution upon which the check was drawn in the 'drawn upon' section.

- Provide the name of the payee or the person that the check was payable to in the corresponding section.

- Specify the reason for dishonor in the section labeled 'reason.' Common reasons include insufficient funds or closed account.

- Calculate any costs associated with this notice, not exceeding $30.00, and enter this amount in the designated 'costs' field.

- Total the amount due (check amount plus costs) and write this in the 'total amount due' field.

- If applicable, inform the recipient that they have a 15-day period to make payment from the receipt of notice.

- Complete the notice issued by section, signing your name, and printing it clearly below.

- Fill in your title in the specified area.

- Save your changes, download, print, or share the completed form as needed.

Complete your online documents now for efficient management.

Related links form

A dishonored check is one that the bank does not honor, often referred to as a bounced check or bad check. This can occur for various reasons, and it signifies that the funds are not available for withdrawal. Knowing what qualifies as a dishonored check can help you stay informed about your financial dealings. For assistance with managing these situations, look into the resources available on the US Legal Forms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.