Loading

Get Form 318

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 318 online

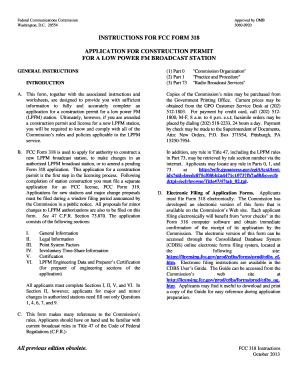

Filling out the FCC Form 318 is an essential process for those seeking to apply for a construction permit for a low power FM broadcast station. This guide provides clear, step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete your Form 318 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, General Information, provide your legal name, mailing address, contact information, and the purpose of your application. Note that if you are amending a prior application, include the applicable file number and location details.

- In Section II, Legal Information, answer the certification questions carefully. Ensure that you certify your eligibility by selecting the appropriate responses, and provide detailed exhibits if required.

- In Section III, Point System Factors, only complete this section if you are a new station or making major changes. Respond to each question regarding community presence, local programming, and diversity of ownership.

- For Section IV, Involuntary Time-Share Information, provide the date your organization became local, affirming your ongoing local presence.

- In Section V, Certification, ensure that all statements are truthful and complete. Remember that false statements may result in penalties.

- In Section VI, LPFM Engineering Data, accurately provide technical specifications and ensure that all entries are complete and consistent with previous sections.

- After completing all sections, review your information for accuracy. You may then save changes, download, print, or share the completed Form 318 as necessary.

Start your application process now by filling out Form 318 online!

Related links form

To fill out a 4868 IRS form, gather your tax information and make sure you understand the extensions process. Enter all required details accurately and clearly state your estimated tax liability. Upon completion, submit the form promptly to avoid penalties and utilize Form 318 for additional information on extensions if needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.