Loading

Get Mo 1040p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 1040p online

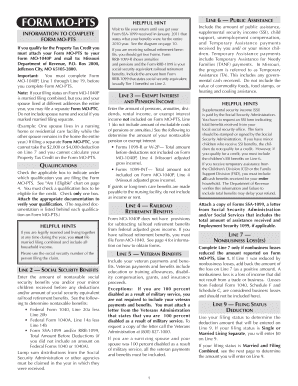

Filling out the Mo 1040p form online can be a straightforward process when you have the right guidance. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the Mo 1040p online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by filling out Line 1 of the Mo 1040p, which includes entering your personal information such as your name, address, and social security number. Ensure all information is accurate to prevent delays in processing.

- Continue to Line 2, where you will enter the amount of nontaxable social security benefits received by you and your minor children. Calculate this amount using the relevant federal forms (1040, 1040A, or SSA-1099), ensuring that you report the total before any deductions.

- Proceed to Line 3 and report any exempt interest and pension income. Ensure that you only include amounts not previously reported on Line 1.

- On Line 6, include the total amount of public assistance you received in the previous year, which encompasses various types of assistance. Be meticulous in gathering the documentation required to verify this information.

- Fill out Line 8 with your total household income, ensuring that all necessary income sources are accounted for. This information is crucial for determining your eligibility for credits.

- Calculate your net household income on Line 10 by subtracting the deductions noted on Line 9 from your total income. Ensure that your reported net income does not exceed the eligibility limits.

- Finalize your form by reviewing Lines 11 through 14, where you will enter your property tax paid or rent, and calculate your property tax credit using the provided chart.

- Once all information is entered, save your changes. You can choose to download, print, or share the completed form based on your needs.

Complete your Mo 1040p and any related documents online today to ensure a smooth filing process.

A Missouri tax ID and an EIN (Employer Identification Number) serve different purposes. The Missouri tax ID identifies your business for state tax purposes, while an EIN is issued by the IRS for federal tax identification. However, both are essential for business operations, especially when filing forms like the Mo 1040p. Be sure to secure both for comprehensive compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.