Loading

Get Mo Ptc 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Ptc 2010 Form online

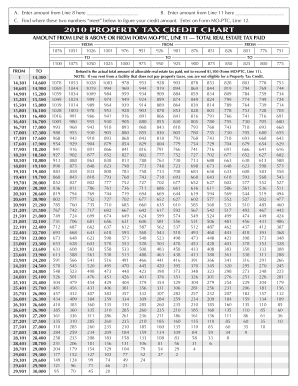

Filling out the Mo Ptc 2010 Form online is an essential step for individuals seeking a property tax credit. This guide provides clear and supportive instructions for accurately completing each component of the form.

Follow the steps to successfully complete the Mo Ptc 2010 Form online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- In field A, enter the amount from Line 8 of the applicable document.

- In field B, input the amount from Line 11 of the applicable document.

- Refer to the property tax credit chart provided to find where the amounts from fields A and B intersect, to determine your credit amount.

- Record the credit amount in Line 12 of the Mo Ptc form.

- Review all entered information for accuracy.

- Once completed, save changes, download a copy of the form, print it, or share it as needed.

Start filling out the Mo Ptc 2010 Form online today to ensure you receive your eligible property tax credit.

If you are wondering where your MO PTC refund is, you can check with your local tax office or access your tax records online. Generally, adjustments made through the Mo PTC 2010 Form can lead to delays in processing refunds. Keep track of all forms submitted and follow up if necessary. USLegalForms provides resources to help you navigate issues related to property tax credits and refunds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.