Get Deed In Lieu Of Foreclosure Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deed in Lieu of Foreclosure Agreement online

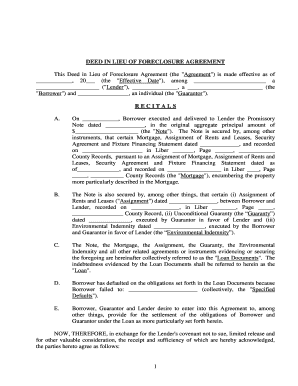

Filling out a Deed in Lieu of Foreclosure Agreement can seem daunting, but with clear guidance, the process becomes manageable. This agreement allows a borrower to convey their property to the lender in exchange for a release from the mortgage obligation, making it a valuable tool in foreclosure situations.

Follow the steps to efficiently complete the Deed in Lieu of Foreclosure Agreement.

- Click ‘Get Form’ button to obtain the Deed in Lieu of Foreclosure Agreement and open it in the online editor.

- In the first section, fill in the effective date of the agreement as prompted, ensuring that the date is correctly stated.

- Identify the lender by typing their name and indicating their legal structure (e.g., corporation, partnership) in the designated fields.

- Next, enter the borrower's information, including their name and structure, in the appropriate sections.

- If applicable, provide the guarantor's information to clarify their role within this agreement.

- Complete the recital section by filling in the details regarding the promissory note, including the original principal amount and any relevant dates.

- Document any specified defaults by clearly defining the obligations that the borrower has not fulfilled.

- In the acknowledgments section, agree to each statement by initialing or marking the indicated boxes, ensuring you fully understand the implications.

- Detail the fees and expenses that are relevant to the transaction; this may involve consulting with a financial advisor or legal expert for accuracy.

- Finally, review all provided information for accuracy before saving your progress; options will be available to download, print, or share the completed document.

Complete your Deed in Lieu of Foreclosure Agreement online today to facilitate a smooth process.

Related links form

A deed in lieu of foreclosure is an agreement between a homeowner and a lender where the homeowner voluntarily transfers the property's title to the lender. This agreement is usually pursued when the homeowner faces financial difficulties and cannot continue making mortgage payments. Overall, it serves as an alternative to foreclosure, helping both parties avoid lengthy court proceedings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.