Loading

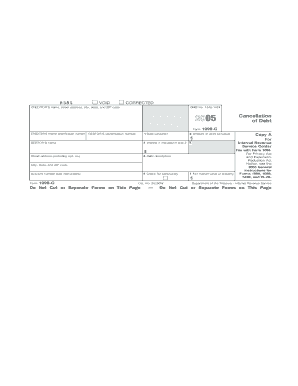

Get Print Tax Form 2005 1099 C

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Print Tax Form 2005 1099 C online

Filling out the Print Tax Form 2005 1099 C online is a straightforward process that requires attention to detail. This guide will walk you through the various components of the form, ensuring you understand each section and can complete it accurately.

Follow the steps to complete your Print Tax Form 2005 1099 C effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the creditor's name and their street address, city, state, and ZIP code. Enter the required information accurately.

- Fill in the creditor's federal identification number, which is necessary for IRS verification.

- In Box 1, provide the date the debt was canceled.

- Enter the total amount of the debt canceled in Box 2.

- If applicable, include any interest included in the canceled debt in Box 3.

- Provide a description of the debt in Box 5.

- Include the debtor's identification number and their name, along with their street address and city/state/ZIP code.

- Complete the account number field as instructed.

- If the debt was canceled as part of a bankruptcy proceeding, check Box 6.

- If there is fair market value of property related to this transaction, indicate it in Box 7.

- Review all entries for accuracy and completeness.

- Finally, save any changes, and choose to download, print, or share the completed form as needed.

Start completing your Print Tax Form 2005 1099 C online today!

If you've lost your 1099-C, you should contact the lender or financial institution that provided the debt cancellation. They can issue a duplicate copy for you. Keeping a record of your financial documents is crucial, and USLegalForms offers tools to help you keep track of all your important tax forms, including the Print Tax Form 2005 1099 C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.