Loading

Get Form 8845

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8845 online

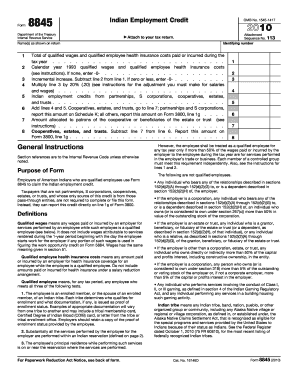

Filling out Form 8845, the Indian Employment Credit form, is an essential task for employers of qualified American Indian employees to claim their credits. This guide provides straightforward instructions for navigating the online completion of this form, ensuring you have all the necessary details at hand.

Follow the steps to fill out Form 8845 online

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter the name(s) of the employer as shown on the tax return in the provided fields.

- Fill in the total of qualified wages and qualified employee health insurance costs paid or incurred during the tax year.

- If applicable, report the calendar year 1993 qualified wages and qualified employee health insurance costs, noting to enter -0- if none.

- Calculate the incremental increase by subtracting line 2 from line 1. If zero or less, enter -0-.

- Multiply the result from line 3 by 20% to determine the credit adjustment needed for salaries and wages.

- If the employer is part of a partnership, S corporation, cooperative, estate, or trust, report any Indian employment credits from those entities accordingly.

- Aggregate lines 4 and 5 to report the combined amount. Make sure to follow the specific instructions for cooperatives, estates, and trusts.

- For cooperatives, estates, and trusts, allocate amounts to patrons or beneficiaries if required, then subtract as instructed.

- Review all entries for accuracy and completeness, then proceed to save changes, download, print, or share the form as needed.

Start completing your documents online with confidence!

You can file Form 4852 when you do not receive your Form W-2 or 1099-R from your employer or payer. It's important to file this form as part of your tax return to accurately report your income. Generally, you can file Form 4852 anytime during the tax season, as long as it is submitted by the tax deadline. Uslegalforms can help ensure you file it correctly and on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.