Loading

Get Cook County Assessor Class 9 Application Part Ii Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cook County Assessor Class 9 Application Part Ii Form online

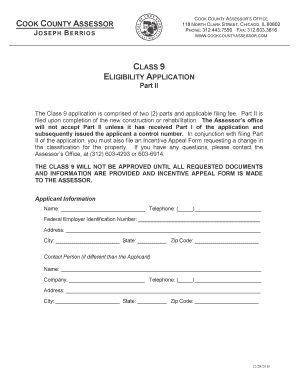

The Cook County Assessor Class 9 Application Part Ii Form is essential for property owners seeking tax incentives for new construction or major rehabilitation projects. This guide provides clear instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the Class 9 Application Part Ii form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the required sections electronically.

- Fill in the applicant information. Provide your name, telephone number, Federal Employer Identification Number, and address. If a different contact person is involved, include their details as well.

- Complete the property description section. Enter the street address and Permanent Real Estate Index Numbers for all applicable properties. If you are applying for more than three properties, attach additional information.

- Indicate the basis for the Class 9 incentive by selecting either 'new construction' or 'major rehabilitation'. Make sure to circle your choice clearly.

- Describe the property after construction or rehabilitation. Specify the gross living area in square feet and the number of dwelling units, as well as how many are designated as senior or Section 8 housing.

- Provide the post-construction or rehabilitation dates and the total costs expended during this process. Make sure to enter accurate figures.

- If applicable, fill out the major rehabilitation costs section with details on the building systems or components that were rehabilitated, including total costs and costs per square foot.

- Gather the required documentation as specified in the form. Ensure that you have all required attachments to support your application, including photographs, compliance documents, and any required certifications.

- Complete the Cook County Living Wage Ordinance section by indicating your compliance status and ensure that it is accurately assessed.

- Sign and date the application, and include notarization as required. This is crucial for the approval of your Class 9 application.

- Once all sections are complete, review the form for accuracy. You can save changes, download the form for printing, or share it as necessary.

Start filling out your Cook County Assessor Class 9 Application Part Ii Form online today!

While walk-ins are sometimes allowed at the Cook County assessor's office, making an appointment is recommended for a smoother experience. Appointments can help you receive personalized assistance when submitting forms like the Cook County Assessor Class 9 Application Part Ii Form. Always check the office's official website for current guidelines regarding visits and appointments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.