Loading

Get Ir Publication 4235

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir Publication 4235 online

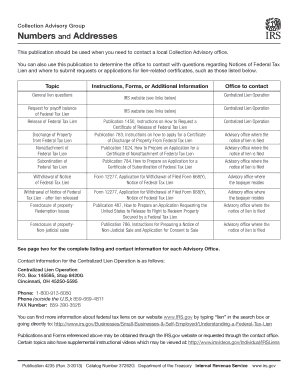

Filling out the Ir Publication 4235 online can be a straightforward process when you have the right guidance. This document provides essential contact information and instructions for liaising with Collection Advisory offices regarding Federal Tax Liens.

Follow the steps to fill out the form accurately.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Review the introduction section of the form, which includes important information about its purpose and how it relates to your tax situation. Ensure you understand when and why to use this publication.

- Fill in your personal information in the designated fields, such as your full name, address, and contact details. Ensure that all information is accurate and up-to-date.

- Refer to the section that details various lien issues. Select the relevant topic for your inquiry, such as 'Request for payoff balance of Federal Tax Lien' or 'Withdrawal of Notice of Federal Tax Lien.'

- Complete any additional fields related to the specific topic you selected. Provide any necessary documentation as indicated, including forms or additional information required for specific requests.

- Review your entire form for accuracy and completeness. Check that all required fields are filled out correctly and that no information is missing.

- Once you are satisfied with your entries, save your changes. You can then choose to download, print, or share the completed document as needed.

Start filling out your documents online today for a smoother process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can pick up IRS publications at your local IRS offices or select community locations such as libraries and government offices. Additionally, the IRS website allows you to download any publication you need, including Ir Publication 4235, providing quick access to vital tax information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.