Loading

Get K5 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K5 Form online

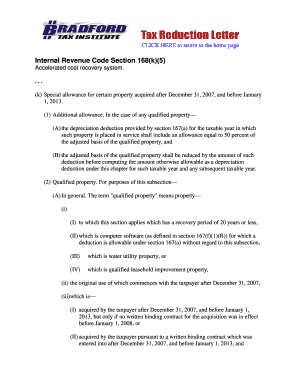

The K5 Form serves as an important document related to tax allowances for qualified property. This guide provides a comprehensive overview on how to fill out the K5 Form online, ensuring users can efficiently complete the process with clarity and confidence.

Follow the steps to fill out the K5 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the introductory section of the form. Ensure to accurately enter your identification details, including your name and taxpayer identification number. Double-check for correctness.

- Proceed to the qualified property section. Here, you must provide specific details about the property you are claiming. Include the date acquired, the adjusted basis, and categorize the property according to the guidelines provided.

- Fill out the depreciation deduction section. It is critical to calculate the allowance accurately as it impacts your tax computations. Follow the prescribed method for calculating these figures based on the potential for accelerated cost recovery.

- Review and confirm all entries for accuracy. It is recommended to cross-check your input against any supporting documents to ensure compliance and correctness.

- Once completed, you can save changes, download, print, or share the form as needed. Ensure that all steps are properly validated before submission.

Complete your K5 Form online today for a streamlined filing experience.

Self-employed individuals must report their income regardless of the amount, but the threshold for owing taxes is usually low. If your net earnings are more than $400, you need to file a tax return and may need to submit a K5 Form. It's advisable to file your taxes even if your income is below this amount to clarify your status. Tax compliance protects you from potential penalties later.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.