Loading

Get Form Va 16

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Va 16 online

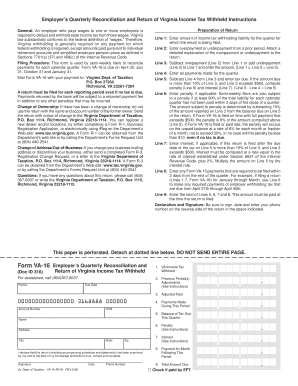

Filling out the Form Va 16 online is an essential process for employers who need to reconcile their Virginia income tax withholding payments. This guide will provide you with a clear, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the Form Va 16 online

- Click the ‘Get Form’ button to download the Form Va 16 and open it in your preferred editor.

- In the first section, enter the amount of income tax withholding liability for the quarter you are reporting.

- For the second section, include any overpayment or underpayment from a previous period, attaching a detailed explanation if necessary.

- In the next section, calculate the adjusted total by subtracting the overpayment from the income tax withholding liability or adding any underpayment to it, and enter this amount.

- Report all payments made during the quarter in the next line.

- Next, determine the balance of tax due for the quarter by subtracting the payments made from the adjusted total.

- If applicable, calculate any penalties, which may apply if your payments were late.

- Calculate any interest owed, especially if your filing is late or if you have a significant balance due.

- If you made any required payments in the month following the reported quarter, include those amounts in this section.

- Finally, sum up all applicable amounts to arrive at the total amount due and be sure to sign, date, and enter your phone number on the reverse side of the form.

Complete your Form Va 16 online to ensure timely compliance with Virginia tax regulations.

You can obtain Virginia tax forms from the Virginia Department of Taxation's official website, where a comprehensive list of required forms is available. Additionally, platforms like UsLegalForms offer easy access to various tax forms, including Form Va 16, simplifying the tax preparation process for residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.