Get 2011 Form Ct 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form CT-1 online

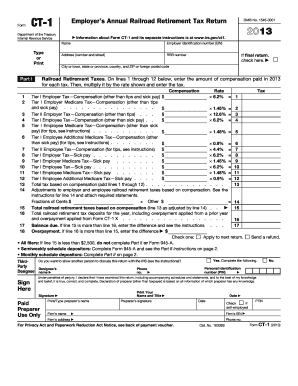

Filling out the 2011 Form CT-1, Employer's Annual Railroad Retirement Tax Return, online can simplify your tax reporting process. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the 2011 Form CT-1 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your name and employer identification number (EIN) in the designated fields at the top of the form.

- Fill in your address, including the number and street, city or town, state or province, country, and ZIP or foreign postal code.

- If you are submitting your final return, check the appropriate box provided.

- In Part I, report the total compensation paid for each tax line from 1 to 12. Calculate each tax by multiplying the compensation by the applicable rate, entering results in the designated areas.

- Add up the total tax amounts from lines 1 through 12 and enter the sum on line 13.

- Complete any necessary adjustments to employer and employee railroad retirement taxes based on compensation as required by the instructions.

- Calculate the total railroad retirement taxes owed and report them in the total fields for lines 15 and 16.

- Indicate any balance due or overpayment as applicable.

- Designate if you want a third party to discuss the return with the IRS, and provide their information if applicable.

- Review and sign the form, providing your name, title, and date.

- If applicable, fill out Part II, detailing the Monthly Summary of Railroad Retirement Tax Liability based on your filing needs.

- Once completed, save your changes. You have the option to download, print, or share the form for submission.

Start completing your documents online today to ensure accurate and timely filing.

To fax your 2011 Form CT-1 and other related forms to the IRS, you should use the designated fax number provided on the IRS website. It is essential to verify the most current fax number, as it may change periodically. Using the correct number ensures your forms are received timely, keeping your tax obligations in good standing. If you need assistance with the process, consider using uslegalforms platform for streamlined solutions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.