Loading

Get 2011 Form 8865

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 8865 online

Filling out the 2011 Form 8865 can seem challenging, but with the right guidance, you can complete it efficiently and accurately. This comprehensive guide will walk you through each section of the form, ensuring you understand the requirements and how to fill it out online.

Follow the steps to accurately complete your 2011 Form 8865 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document management tool.

- Review the instructions provided with the form carefully. This section will clarify eligibility and necessary information you need to have on hand.

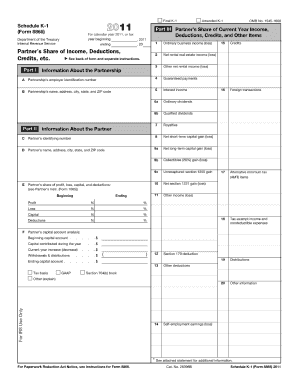

- Begin filling out Part I of the form, which requires general information about the partnership and its partners. Be sure to provide accurate names, addresses, and tax identification numbers.

- Proceed to Part II, where you will need to report income, deductions, and credits allocated to the partners. Ensure you enter the correct figures to avoid discrepancies.

- Complete Part III, which asks for information regarding the partnership's assets. This section may require you to attach additional documentation in certain instances.

- Move on to Part IV to disclose any additional information required. This might include specific transactions that took place and any related events.

- Finally, review the entire form for accuracy. Double-check your entries for completeness and correctness before moving to the next step.

- Once satisfied with the form, you can save your changes, download a copy for your records, print it out, or share it if required.

Complete your 2011 Form 8865 online to ensure compliance and accurate reporting.

Filing your 2011 tax return involves gathering your income documents, deductions, and credits. Make sure to complete the necessary forms, including the 2011 Form 8865 if required. Then, you can choose to file your return by mail or electronically through an IRS-approved e-filing service. For an easier experience, consider using a solution like US Legal Forms to access the forms you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.