Loading

Get 2009 Schedule B 1 Form 1065

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Schedule B 1 Form 1065 online

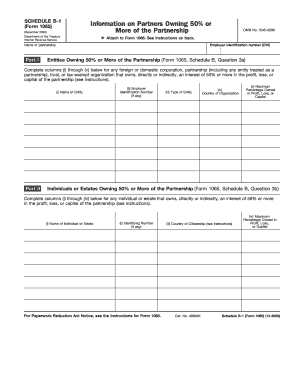

Filling out the 2009 Schedule B 1 Form 1065 online is essential for partnerships that have specific ownership structures. This guide aims to provide clear, step-by-step instructions to help users navigate the form with ease.

Follow the steps to complete the 2009 Schedule B 1 Form 1065 online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter the name of the partnership at the top of the form.

- Complete Part I if the partnership answered 'Yes' to question 3a on Form 1065. Fill out columns (i) through (v) for each entity owning 50% or more of the partnership. Include the name of the entity, their employer identification number (EIN), type of entity, country of organization, and maximum percentage owned.

- Move to Part II if the partnership answered 'Yes' to question 3b on Form 1065. Fill out columns (i) through (iv) for each individual or estate owning 50% or more. Provide the individual's name, identifying number, country of citizenship, and maximum percentage owned.

- Review all entries for completeness and accuracy.

- Once filled out, you can save the changes, download, print, or share the form as necessary.

Complete your 2009 Schedule B 1 Form 1065 online for a smooth filing experience.

Yes, you can use TurboTax to file Form 1065, including the 2009 Schedule B 1 Form 1065. TurboTax provides a user-friendly interface and supports the completion of various forms. For those seeking a straightforward way to handle their tax filings, TurboTax is a valuable option.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.