Get Financegovskcataxesefile Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financegovskcataxesefile Form online

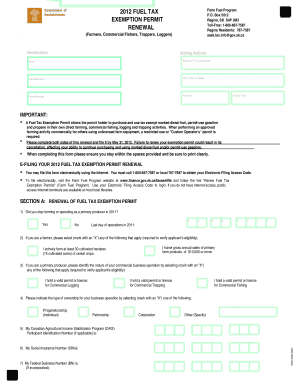

Filing the Financegovskcataxesefile Form online is a straightforward process designed to streamline your application for the Fuel Tax Exemption Permit renewal. This guide will walk you through each step, ensuring that you provide accurate information to maintain your eligibility.

Follow the steps to fill out the Financegovskcataxesefile Form effectively.

- Click the ‘Get Form’ button to obtain the Financegovskcataxesefile Form and open it in your preferred online editor.

- Begin by filling out the identification section. Enter your mailing address, including the street or P.O. Box number, city, province, and postal code. Also, provide your business name and permit number.

- Indicate whether you stopped farming or operating as a primary producer in 2011 by selecting 'Yes' or 'No' and provide the last day of operations if applicable.

- If you are a farmer, select the qualifications that apply to verify your eligibility, indicating your gross annual sales or the amount of cultivated land.

- For primary producers, identify your commercial business operation by selecting the applicable options related to logging, trapping, or fishing.

- Indicate your type of business ownership by selecting one of the following: proprietorship, partnership, corporation, or other, and provide necessary details.

- Provide your Social Insurance Number, Federal Business Number, and any applicable Canadian Agricultural Income Stabilization Program Participant Identification Number.

- Complete the section for Gasoline and Propane Diversion Declaration, detailing the amount of fuel purchased and the applicable tax rate.

- Calculate the total fuel tax balance owing and ensure you include payment details as necessary.

- Finalize the form by signing and dating your applicant declaration, affirming the accuracy of your information.

- Once completed, save changes to your form, and you may opt to download, print, or share it as needed.

Complete your Financegovskcataxesefile Form online today to ensure your continued participation in the Fuel Tax Exemption Program.

Related links form

A beginner should start by gathering all necessary documents, such as W-2s, 1099s, and any receipts for deductions. Using the Financegovskcataxesefile Form can simplify this process. Beginners might also want to consult tax preparation software or services like uslegalforms, which offer step-by-step guidance. Taking your time to understand the forms and available credits can lead to a smoother experience and possibly a better refund.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.