Loading

Get 8879 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8879 form online

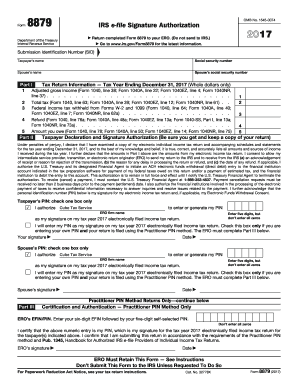

Filling out the 8879 form, which serves as the IRS e-file signature authorization, can be straightforward with a guided approach. This comprehensive guide will walk you through each section and field of the form, ensuring a smooth online completion process.

Follow the steps to fill out the 8879 form online effectively.

- Press the ‘Get Form’ button to access the 8879 form and open it in your preferred online editor.

- Begin with the taxpayer’s section by entering the taxpayer’s name and social security number. If applicable, also provide the spouse’s name and social security number.

- Proceed to Part I where you will fill in the tax return information. Enter the adjusted gross income as indicated on your tax return documents based on the relevant form (Form 1040, 1040A, or 1040EZ). Ensure that the amounts are in whole dollars only.

- Next, complete the total tax line by inputting the appropriate figure from your tax return. Follow this with the federal income tax withheld, also derived from your tax documents.

- After entering these amounts, state any refund expected or amount owed based on your tax calculations, referencing the correct lines from your tax return.

- In Part II, confirm the taxpayer declaration and signature authorization. Review and ensure that everything is accurate before proceeding to acknowledge understanding and consent to the specified terms.

- Sign the form, either by entering your personal identification number (PIN) or authorizing your ERO. If using your own PIN, check the appropriate box.

- If applicable, repeat the process for the spouse's information, including their signature or authorization.

- Finally, save the changes to your form. You can choose to download, print, or share the completed form as needed. Make sure to send a copy to your Electronic Return Originator (ERO) rather than submitting it to the IRS directly.

Complete your documents online today and ensure a hassle-free filing process.

The difference between the 8879 Form and the 1040 form is quite clear. The 1040 Form is your actual tax return, detailing your income, deductions, and tax liability. Meanwhile, the 8879 Form is solely for authorizing the e-filing of that tax return. Understanding both these forms and their functions is key to navigating your tax filing smoothly and avoiding any potential errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.