Loading

Get Irs Form 990 N

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 990 N online

This guide provides a comprehensive overview of how to fill out IRS Form 990 N online. Designed for organizations with gross receipts of less than $25,000, this form must be submitted annually to maintain tax-exempt status.

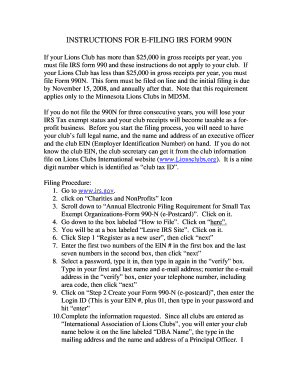

Follow the steps to complete your IRS Form 990 N online.

- Press the ‘Get Form’ button to obtain the form and open it in your selected editor.

- Visit the official IRS website. Look for the 'Charities and NonProfits' icon and click on it.

- Scroll down to find the section about the annual electronic filing requirement for small tax-exempt organizations, specifically Form 990-N (e-Postcard). Click on this link.

- Once on the next page, identify the box labeled 'How to File' and click on the provided link.

- A box titled 'Leave IRS Site' will pop up; click on it to proceed.

- In Step 1, select to register as a new user, then click 'next'.

- Enter the first two digits of your club’s EIN in the first box and the last seven digits in the second box, then click 'next'.

- Choose a password, confirm it, and provide personal information including your first and last name, email address, and telephone number. Click 'next' when complete.

- In Step 2, create your Form 990-N (e-postcard). Input your Login ID, which consists of your EIN followed by '01', enter your password, and hit 'enter'.

- Fill out the required information. As all clubs are listed as 'International Association of Lions Clubs', type your club’s name in the DBA Name field, followed by the mailing address and the name and address of the Principal Officer.

- After completing the form, print a copy for your records. Click on 'save changes', then 'submit Filing to IRS'. You will receive an email confirming your submission.

Complete your IRS Form 990 N online today to ensure your organization maintains its tax-exempt status.

Unlike traditional mailing processes, you do not send IRS Form 990-N anywhere. Instead, you file it electronically through the IRS or an authorized e-file provider. This method is more effective than mailing forms, ensuring that your form is processed quickly and accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.