Get Advisor Agreement For Giving Account Access - Fidelity Charitable - Fidelitycharitable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Advisor Agreement For Giving Account Access - Fidelity Charitable - Fidelitycharitable online

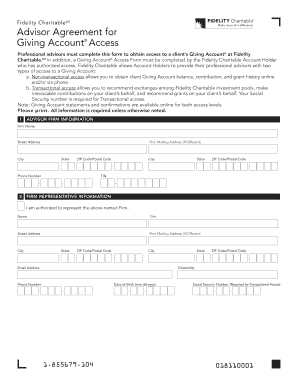

Completing the Advisor Agreement for Giving Account Access is essential for professional advisors seeking access to a client's Giving Account at Fidelity Charitable. This guide will walk you through the necessary steps to successfully fill out this form online.

Follow the steps to complete the Advisor Agreement for Giving Account Access.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the advisor firm information by entering the firm name, street address, city, state, ZIP code, and phone number in the designated fields. If the mailing address differs from the street address, ensure to input that information as well.

- Fill in the firm representative information, including their name, title, and street address. Complete the mailing address details, if different, along with city, state, ZIP code, email address, citizenship, phone number, date of birth, and social security number if applying for transactional access.

- Establish an Individual User ID for access to your client's Giving Account. This ID must be between 4 to 12 characters long and is your responsibility; it should not be shared with others in your firm.

- Review the access agreement statement to ensure you understand the responsibilities associated with accessing the Giving Account. After reading, provide your signature and date to confirm your agreement.

- Once completed, decide whether to save any changes, download, print, or share the form as needed. Ensure the form is submitted as required, either by mailing or faxing it to the appropriate Fidelity Charitable address.

Start filling out the Advisor Agreement online today to gain access to your client's Giving Account.

To give someone access to your Fidelity account, you typically need to set them up as an authorized user. This process involves submitting a request through your account settings or contacting customer support. By granting access, they can manage investments and make decisions based on your pre-defined guidelines. Familiarizing yourself with the Advisor Agreement For Giving Account Access - Fidelity Charitable - Fidelitycharitable will help ensure that you maintain control while allowing others to assist in your charitable endeavors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.