Loading

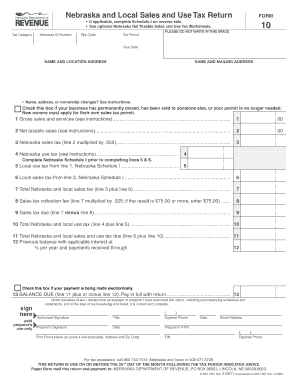

Get Nebraska Form 10 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Form 10 Fillable online

Filling out the Nebraska Form 10 Fillable online is a straightforward process that allows businesses to report their sales and use tax accurately. This guide will provide clear, step-by-step instructions on how to complete each section of the form effectively.

Follow the steps to complete your Nebraska Form 10 Fillable online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter your Nebraska ID number in the designated field at the top of the form to identify your business.

- Fill in the tax period for which you are reporting. This is usually the month to which the sales and use taxes apply.

- Provide your business name and location address in the appropriate sections. If there have been any changes in ownership or address, document them as instructed.

- Complete the Gross sales and services section by entering the total dollar amount of all sales, including both taxable and exempt sales on line 1.

- Calculate your net taxable sales by entering the allowable deductions on line 2.

- Determine your Nebraska sales tax by multiplying the net taxable sales by the appropriate rate and entering the result on line 3.

- Complete the local and use tax sections as necessary, using the Nebraska Schedule I to report local sales and use taxes.

- Add lines 3 and 6 to find the total Nebraska and local sales tax, and then enter this amount on line 7.

- Calculate any sales tax collection fees and enter this on line 8, followed by determining the total sales tax due on line 9.

- Fill in total use tax amounts on lines 10 and 11, ensuring all calculations are accurate.

- Review the payment information on line 13, ensuring you check the box if submitting electronically.

- Finally, add your signature in the designated area, affirming that the information provided is true and complete.

- After filling out the form, users can save changes, download, print, or share the completed document as needed.

Start completing your Nebraska Form 10 Fillable online today to ensure compliance with tax regulations.

Filling out a PDF tax form can be done easily with the right tools. Start by downloading the Nebraska Form 10 Fillable as a PDF, then open it using a PDF reader. Input your information directly into the fields, and save your changes. If you prefer a guided approach, uslegalforms offers options that make filling out PDF forms user-friendly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.