Loading

Get Foram Vat A2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Foram Vat A2 Form online

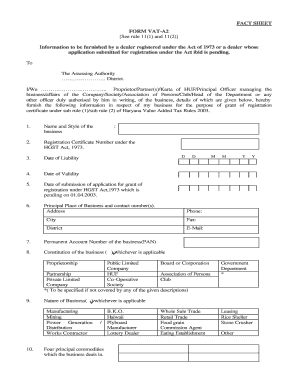

The Foram Vat A2 Form serves as a key document for dealers seeking registration under the Haryana Value Added Tax Act. This guide provides a structured approach to filling out the form online, ensuring you accurately complete each required section.

Follow the steps to efficiently complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering the name and style of your business in the designated field.

- Provide your Registration Certificate Number under the HGST Act, 1973.

- Indicate the date of liability and the date of validity.

- Fill in the date of submission for the application of grant of registration under the HGST Act, 1973 if your application is pending.

- Complete the section for the principal place of business, including the contact number and email address.

- Enter your Permanent Account Number (PAN) in the specified field.

- Select the constitution of the business from the provided options (e.g., proprietorship, partnership, etc.).

- Describe the nature of your business by choosing from the available categories.

- List the four principal commodities your business deals in.

- Input the Economic Activity Code as per schedule I of VAT Rules.

- Provide details of your bank account, including the name of the bank, type of account, and the account number.

- Disclose any immovable properties owned wholly or partly by the business, including approximate values.

- Specify the script in which your account books are maintained.

- Attach Annexure-I with details of the proprietor, partners, Karta of HUF, and directors if applicable.

- Ensure to include a copy of the partnership deed or Memorandum of Articles of Association if applicable.

- Attach Annexure-II for additional places of business, if any.

- Provide the list of goods required to be purchased at a concessional rate of tax under the relevant section in Annexure-III.

- Include details of any security furnished as required in Annexure-IV.

- Attach the details of closing stock as of a specified date in Annexure-V.

- Paste passport-sized photographs of the proprietor, partners, Karta of HUF, and directors at the designated space.

- Complete the verification section by affirming that the information provided is true and correct, and provide the necessary signatures.

- At the final step, save your changes, download, print, or share the completed form as needed.

Complete your Foram Vat A2 Form online today to ensure a smooth registration process.

You can obtain the Foram Vat A2 Form from authorized banks and financial institutions that deal with foreign remittances. Many banks also provide access to the A2 Form online through their banking portals. This simplifies the process and allows for faster submissions. For a comprehensive guide on obtaining and completing this form, visit U.S. Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.