Loading

Get Solvency Ratio Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Solvency Ratio Form online

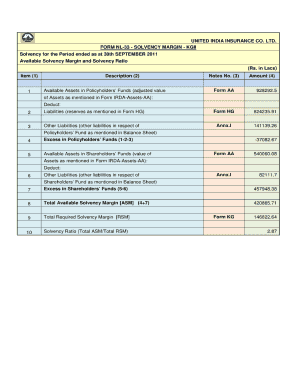

This guide provides a comprehensive overview of how to accurately fill out the Solvency Ratio Form online. By following these step-by-step instructions, you will ensure that the form is completed correctly and efficiently.

Follow the steps to complete the Solvency Ratio Form online

- Click the ‘Get Form’ button to obtain the Solvency Ratio Form and open it in your preferred online editing tool.

- Begin by entering your company's name in the designated field. Ensure that the name is spelled correctly and matches your official business documents.

- Next, provide the fiscal period for which you are calculating the solvency ratio. This is typically a date range that should clearly indicate the start and end dates.

- In the financial data section, you will be required to input total assets and total liabilities. Make sure to enter the accurate figures as these will directly affect your solvency ratio calculation.

- Once all the financial data is entered, review the calculations that automatically generate the solvency ratio based on the information provided.

- If necessary, add any additional notes or comments in the specified field to clarify any unique circumstances regarding your financial data.

- Before finalizing, double-check all entries for accuracy, and make any required adjustments.

- Finally, you can save your changes, download a copy, print the document, or share it with required parties.

Complete the Solvency Ratio Form online today to analyze your financial health!

To check the solvency ratio, initially calculate it using your financial statements as mentioned. Make sure the figures utilized are accurate and up to date. By reviewing and updating the data in your Solvency Ratio Form, you can continuously monitor your financial health.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.