Loading

Get Form8615

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8615 online

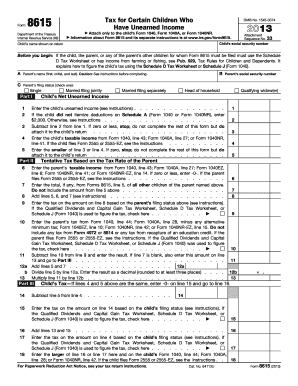

Filling out the Form 8615 online can be straightforward with the right guidance. This form, used to calculate tax for certain children who have unearned income, requires specific information about the child, their parents, and financial details.

Follow the steps to complete the Form 8615 efficiently.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter the child’s social security number in the designated field.

- Provide the child’s name as it appears on their tax return.

- Input the parent’s name, including the first name, middle initial, and last name.

- Select the parent’s filing status by checking the appropriate box for single, married filing separately, married filing jointly, head of household, or qualifying widow(er).

- Fill in the parent’s social security number in the specified section.

- Report the child’s unearned income on the corresponding line.

- If applicable, enter the amount of any deductions the child did not itemize, typically set at $2,000.

- Subtract line 2 from line 1, and if this result is zero or lower, you will need to stop here and attach this form to the child’s return.

- Provide the child’s taxable income from their relevant tax form.

- Enter the smaller value of lines 3 or 4, and stop here if this is zero; attach the form to the child’s return.

- Complete Part II by entering the parent's taxable income and other relevant fields to establish the tentative tax based on their income.

- Calculate the final child’s tax based on the entries and ensure total values are summarized as needed.

- Once all fields are filled, review the form for accuracy.

- Save your changes, and then download, print, or share the completed form as necessary.

Complete your Form 8615 online today to ensure accurate tax reporting.

Yes, you should file Form 8615 if your child's unearned income exceeds the allowable limit. The form allows you to report this income and determine the applicable tax rate. Ensuring this form is filed correctly helps avoid potential issues with tax authorities. For clear instructions on filling out the form, you might explore the resources on UsLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.