Loading

Get Irs Attach To From 1040nr Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Attach To Form 1040NR online

This guide provides a clear and supportive overview of how to fill out the IRS Attach To Form 1040NR online. Following these steps will help ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the IRS Attach To Form 1040NR online:

- Press the ‘Get Form’ button to obtain the IRS Attach To Form 1040NR and open it in your form editor.

- Enter your Social Security number at the top of the form, ensuring accuracy for proper identification.

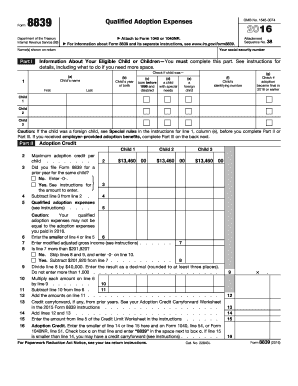

- Under the section labeled 'Information About Your Eligible Child or Children', provide the necessary details for each child, including their names, birth years, and whether they are foreign children. Ensure to follow the guidelines for children with special needs.

- In Part II, input the maximum adoption credit per child, and indicate if you have filed Form 8839 for the same child in a previous year. Follow the calculation steps provided to determine your qualified adoption expenses.

- Continue to Part III to report any employer-provided adoption benefits you received. Complete each corresponding line accurately.

- After thoroughly reviewing all entered information for correctness, save your changes, and prepare to download or print the completed form.

Complete the IRS Attach To Form 1040NR online today to ensure your adoption expenses are properly accounted for.

A nonresident alien can indeed e-file, as long as they use the right tax preparation software. These programs should support the IRS Attach To From 1040NR Form and help ensure your submission meets IRS requirements. Look for platforms with specific provisions for non-resident filings for an easier experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.