Loading

Get Xxxxxerid Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Xxxxxerid Form online

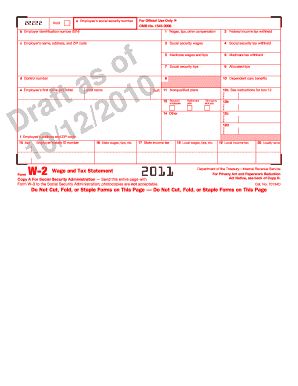

Filling out the Xxxxxerid Form online can be a straightforward process when you understand each section's requirements. This guide provides step-by-step instructions to help you navigate through the form efficiently and accurately.

Follow the steps to successfully complete the Xxxxxerid Form online.

- Click the ‘Get Form’ button to access the online version of the form and open it in your preferred editing tool.

- Begin by entering the employee's social security number in the designated field labeled 'Employee’s social security number.' Make sure to double-check the accuracy of this information to avoid issues later.

- In the section labeled 'Employer identification number (EIN),' input the employer's EIN to verify the employment status. Remember this number is crucial for tax identification.

- Provide details about wages, tips, and other compensation in the respective fields. Fill in the total wages in the field for 'Wages, tips, other compensation,' ensuring the amount is accurate.

- Input the correct federal income tax withheld in the relevant field. This information is essential for determining tax obligations.

- Continue filling out the form by entering the employer's name, address, and ZIP code. This ensures accurate delivery and processing.

- Proceed to fill in other necessary fields such as social security wages, Medicare wages and tips, and any allocated tips if applicable.

- Complete the personal information section by providing the employee's full name and address, ensuring all details align with official documents.

- After filling out all necessary sections, review the form for accuracy and completeness. Ensure all calculations reflect the correct amounts.

- Once you have verified everything is accurate, you can save your changes, download a copy for your records, print the form, or share it as needed.

Start filling out your Xxxxxerid Form online today for a smooth experience.

Related links form

Yes, you can withdraw the 10IEA form in the same year if your circumstances change. However, it is crucial to understand the implications of such a withdrawal on your tax situation. Consult the guidelines provided by the tax authority or a tax professional to ensure you follow the correct procedures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.