Loading

Get Where To Send Mf 001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Where To Send MF 001 online

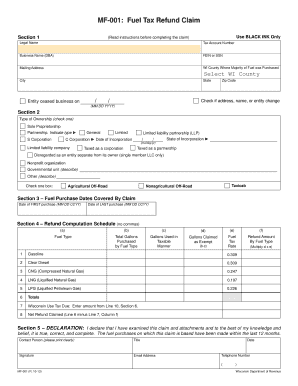

Filling out the MF 001 form, also known as the fuel tax refund claim, can be a straightforward process if you follow the guidelines closely. This guide will walk you through each section of the form, ensuring that you can complete it correctly and efficiently.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to access the MF 001 fuel tax refund claim form and open it for editing.

- In Section 1, use black ink only and fill in your legal name, tax account number, business name (DBA), FEIN or SSN, and mailing address. Ensure you also indicate the Wisconsin county where the majority of fuel was purchased, along with your city, state, and zip code. If any of your information has changed, check the appropriate box.

- In Section 2, select the type of ownership by checking one box, whether you are a sole proprietorship, partnership, corporation, or other entity. If applicable, provide the state of incorporation and the date of incorporation.

- In Section 3, enter the date of your first and last fuel purchase covered by this claim, formatted as MM DD CCYY.

- In Section 4, complete the refund computation schedule by filling out the fuel type, the total gallons purchased, gallons used in a taxable manner, gallons claimed as exempt, fuel tax rate, and refund amount by fuel type. Be sure to also calculate the net refund claimed by subtracting the use tax due.

- In Section 5, declare the accuracy of your claim by signing and providing the contact person’s title, email address, date, and telephone number.

- If applicable, fill out Section 6 regarding use tax due on motor fuel purchases, including whether you are exempt from use tax and providing necessary details.

- Continue to Section 7 and Section 8 if you have equipment or taxicab claims, respectively, by supplying all requested details and ensuring completeness.

- Finally, review all entries for accuracy, save your changes, and when ready, download, print, or share the form as necessary.

Begin completing your fuel tax refund claim online today.

To show proof of investment income, you can use documents like bank statements, dividend statements, or tax forms that highlight your earnings from investments. Ensure you keep all records organized and detailed for verification. Being transparent and accurate will aid in confirming your income levels. If you're still uncertain about where to send Mf 001, let uslegalforms help you navigate these requirements efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.