Loading

Get It 204 Ip Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 204 Ip Form online

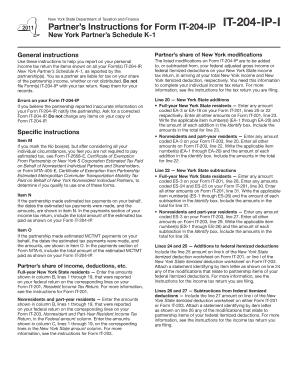

This guide will help you navigate the process of completing the It 204 Ip Form online, ensuring accurate reporting of your partnership income. By following these steps, you will be better equipped to manage your tax responsibilities efficiently.

Follow the steps to fill out the It 204 Ip Form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general instructions carefully. Ensure that you understand your responsibilities regarding the partnership income, even if it has not been distributed.

- In section for additions to New York State income, enter the relevant coded amounts specified for full-year New York State residents or non-residents, as applicable.

- For subtractions from New York State income, similarly input the amounts according to your residency status, ensuring to reference the corresponding codes.

- Complete the partner's share of income, deductions, etc., by transferring necessary figures from your federal return to the forms IT-201 or IT-203.

- Fill in lines related to New York adjustments to tax preference items as instructed, using the amounts that apply to you.

- Enter your partner's credit information, including any applicable credits from your partnership that will affect your individual tax return.

- Finally, ensure all information is accurate, save your changes, and if required, download, print, or share the completed form.

Start filling out your It 204 Ip Form online today to stay on top of your tax obligations.

Form IT-201 is the New York State Resident Income Tax Return used by individuals filing as residents. In contrast, Form IT-203 is for non-residents and part-year residents. Both forms serve crucial roles in ensuring that taxpayers fulfill their state income tax obligations, complementing those who file the It 204 Ip Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.