Loading

Get Vat Form Stchristo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Form Stchristo online

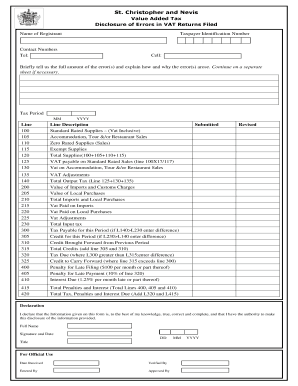

The Vat Form Stchristo is a crucial document for disclosing errors in value added tax returns filed in St. Christopher and Nevis. This guide provides a clear overview and step-by-step instructions to help users complete the form efficiently and accurately online.

Follow the steps to fill out the Vat Form Stchristo online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary sections to begin filling out the form.

- Enter the name of the registrant in the designated field. Ensure that the name matches the registration documents to avoid discrepancies.

- Fill in the taxpayer identification number (TIN) accurately. This number is essential for record-keeping and validation purposes.

- Provide contact numbers, including a telephone number and a cell number, to ensure correct communication regarding the submission.

- Briefly explain the full amount of the error(s) in the relevant field. Clarify how and why these errors occurred. If more space is needed, continue your explanation on a separate sheet.

- Indicate the tax period for which you are making this disclosure. Fill out the month and year accurately.

- Complete the lines related to supplies, including standard rated, zero rated, and exempt supplies. Each line requires accurate financial figures corresponding to transactions.

- Calculate the VAT payable on standard rated sales by applying the formula given (line 100 multiplied by 17/117). Input this figure in the relevant field.

- Document VAT adjustments and total output tax accurately. Fill in the value of imports and any VAT paid on imports and local purchases.

- Calculate and summarize tax payable or credits for the period based on the values you have entered. Include penalties and interest if applicable.

- In the declaration section, confirm the accuracy of all information provided, include your full name, provide a signature, and date the form appropriately.

- Finally, review all entries for accuracy. Once satisfied, you can save changes, download the form, print it, or share it as required.

Complete your Vat Form Stchristo online today to ensure timely processing and compliance.

Filling out a VAT receipt involves using the Vat Form Stchristo to ensure all necessary information is included. Include details such as your business name, the customer's information, a description of the goods or services provided, and the total VAT charged. Accuracy is crucial, as this receipt serves as documentation for both you and your customer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.