Loading

Get M 2210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M 2210 online

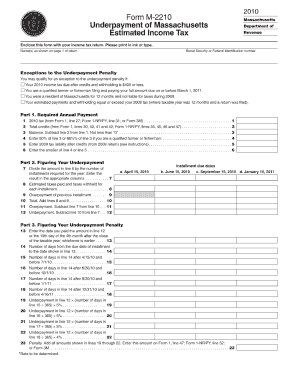

The M 2210 form is essential for reporting tax information. This guide will provide you with clear and concise instructions on how to complete this form online, ensuring you understand each section and field.

Follow the steps to successfully complete the M 2210 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form's introductory section, which outlines important information about its purpose and instructions. Make sure you understand the context in which the M 2210 is used.

- Fill out your personal information in the designated fields. This typically includes your name, address, and social security number or identification number.

- Complete the sections relevant to your specific situation. This may include detailing your income, tax credits, or deductions. Carefully read the instructions accompanying each section for clarity.

- Check the calculation sections on the form if applicable. Ensure that all figures are accurate and verify your totals to prevent errors.

- Once you have filled in all necessary fields, review your form thoroughly to confirm that all information is correct and complete.

- Save your progress. You may then choose to download, print, or share the completed form as necessary.

Complete your M 2210 form online today for an efficient filing experience.

You may need to fill out form 2210 if you believe you have underpaid your taxes throughout the year. This form specifically addresses underpayment penalties, making it essential for accurate tax reporting. Even if you are unsure, reviewing the guidelines under M 2210 can clarify whether your situation requires this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.