Get 2e Naya Saral Naya Saral Its

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2e Naya Saral Naya Saral Its online

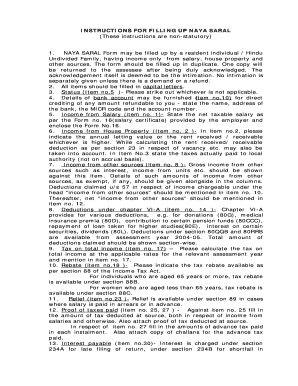

Filling out the 2e Naya Saral Naya Saral Its form is an essential process for individuals and Hindu Undivided Families reporting their income. This guide will provide a detailed walkthrough on how to accurately complete the form online, ensuring that all necessary information is clearly and correctly filled out.

Follow the steps to complete the 2e Naya Saral Naya Saral Its online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by filling in the personal details in capital letters, including your name, address, and contact information in the designated fields.

- Indicate your Permanent Account Number (PAN) and date of birth. Ensure that you select your status as either 'Individual' or 'Hindu Undivided Family' by crossing out the option that is not applicable.

- Provide the particulars of your bank account. This includes the bank's name, address, MICR code, and account number to facilitate direct crediting of any refundable tax amounts.

- In the income section, state your total taxable salary as reported on Form No. 16. Attach this form as evidence.

- For income from house property, declare the higher of the annual rent received or receivable. Include any applicable deductions for vacant periods.

- Report your gross income from other sources, such as interest or dividends. Mention any exemptions and list deductions claimed under section 57.

- Fill in the deductions under Chapter VI-A, detailing donations, medical insurance, and pension contributions. Total these deductions.

- Calculate the tax on your total income according to the applicable rates for your assessment year and enter the amount.

- State any tax rebates for which you qualify, indicating sections corresponding to your eligibility.

- Document the proof of any taxes paid, including TDS amounts and advance tax payments. Attach necessary documents as required.

- Indicate any applicable interest payable on late tax filings or shortfalls in advance tax payments.

- Finally, fill in the amount of tax payable or refundable, making sure to summarize all amounts accurately.

- Review all sections for completeness and accuracy before saving your changes, then proceed to download, print, or share the completed form as required.

Start completing your 2e Naya Saral Naya Saral Its online today to ensure timely and accurate submission.

Choosing between ITR 1, 2, or 3 depends on your income sources and status. Typically, ITR 1 is for salaried individuals, while ITR 2 and 3 accommodate different categories, such as partnership or company income. The 2e Naya Saral Naya Saral Its tool helps you determine the right form by asking relevant questions. By following its recommendations, you can select the appropriate ITR with confidence.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.