Get Form It 260

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-260 online

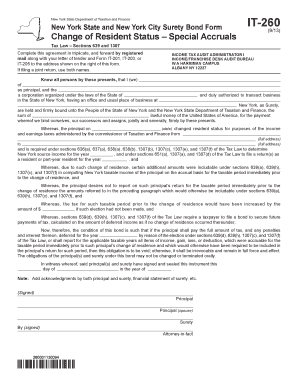

Filling out the Form IT-260 is a crucial step for people undergoing a change of resident status in New York, particularly for tax purposes. This document serves as a surety bond, ensuring compliance with state tax laws. Follow the steps outlined below to complete this form accurately and efficiently in an online format.

Follow the steps to complete the Form IT-260 online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the full name of the principal in the designated field. This should be the person undergoing the change of resident status.

- Fill in the principal's address, ensuring that it reflects the previous location prior to the change of residence.

- Next, specify the name of the surety corporation and its relevant business address, confirming that it is authorized to operate in New York.

- Indicate the total amount for the bond in lawful US currency that guarantees payment of any deferred tax obligations.

- Provide the date the principal changed resident status, along with the incomes' year that must be reported.

- State the applicable taxable years for file returns as a resident or part-year resident, ensuring all details align with New York state tax laws.

- Detail any applicable additional amounts that will be included under tax sections, such as sections 639(a) and 1307(c).

- Include the statement that reaffirms the principal's intention not to report certain amounts and detail the relevant tax implications that arise from this decision.

- Finalize the document by ensuring all signatures are included: the principal, any spouse if filing jointly, and the surety's attorney-in-fact.

- After thoroughly reviewing the filled-out form for accuracy, save your changes, download, print, or share the form as needed.

Take the next step in your tax process by completing the Form IT-260 online today.

When deciding whether to put '0' or '1' on your tax form, consider your personal tax situation carefully. For instance, if you are claiming exemptions, you would enter a '1' if applicable and '0' if not. Using Form It 260 can help clarify your situation based on your financial status. It's essential to follow the guidelines laid out for your specific form to avoid any confusion.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.