Loading

Get Subordination Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subordination Agreement online

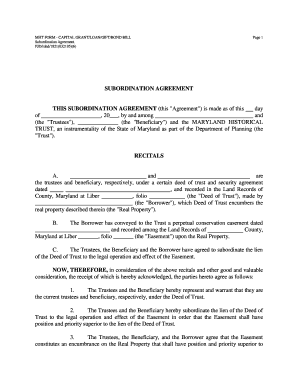

The Subordination Agreement is a crucial document that outlines the terms under which a lien is subordinated to another. This guide will provide you with a comprehensive and user-friendly approach to completing this document online, ensuring that you understand each component and its significance.

Follow the steps to complete your Subordination Agreement effectively

- Click ‘Get Form’ button to obtain the Subordination Agreement and open it in your preferred digital editor.

- Fill in the date at the top of the form, ensuring it reflects the current date or the date of agreement execution.

- Enter the full names of the parties involved including the Trustees, Beneficiary, and the Maryland Historical Trust. Make sure the spelling is correct.

- In the Recitals section, specify the details of the Deed of Trust, including the date recorded and the relevant county information. This establishes the context of the lien.

- Document the information about the Easement in the same manner, providing the date and county of record to ensure clarity on the encumbrance.

- Complete sections regarding the representation and warranties, confirming the roles of all parties involved in the agreement.

- Carefully review the clauses that establish the subordination of the Deed of Trust to the Easement, ensuring that you understand the implications of this legal structure.

- Lastly, confirm that all parties sign and date the agreement where indicated, including spaces for witnesses and notarization if required.

- After ensuring all information is accurate, save your changes before you download, print, or share the completed form.

Start completing your Subordination Agreement online today!

To complete a subordination agreement, begin by gathering all necessary documents related to the loans involved. Clearly outline the rights and obligations of each party, ensuring that the primary lender's interests are prioritized. You can simplify this process by using resources from platforms like US Legal Forms, which provide templates and guidance tailored for your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.