Get 2013 F8812 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 F8812 Form online

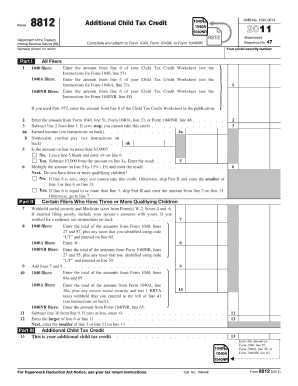

The 2013 F8812 Form is essential for those looking to claim the additional child tax credit. This guide provides clear instructions on how to accurately complete the form online, ensuring you understand each section to maximize your benefits.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number. Ensure accuracy to avoid processing delays.

- In the income section, provide details regarding your earnings, including any wages, salaries, or self-employment income. Make sure to include any tax-exempt income as well.

- Next, indicate your eligibility for the additional child tax credit by answering questions related to your dependents. Ensure that you list each child accurately, including their names and Social Security numbers.

- Review the calculation section to determine the amount of credit you may be eligible for based on your provided income and the number of qualifying children.

- Once all fields are completed, review your entries for accuracy. It is recommended to verify that all information matches supporting documents.

- Finally, save your changes, and choose the options to download, print, or share the form as required for submission.

Start filling out your 2013 F8812 Form online today for a smoother tax experience.

Obtaining form 8862 is straightforward; you can download it directly from the IRS website or access it through various tax preparation software. The form is publicly available, ensuring that you can easily find it when you need it. If you prefer, using platforms like US Legal Forms can also provide you with the 8862 form and user-friendly instructions. Knowing where to access these forms, just like the 2013 F8812 Form, can save you time and stress.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.