Get Form 1068

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1068 online

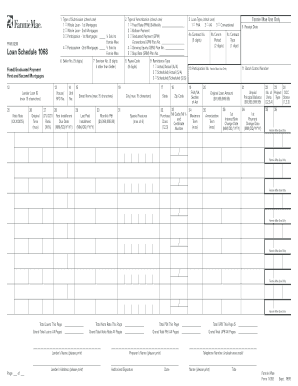

Filling out the Form 1068 is an essential step for lenders when submitting loan delivery data, particularly in emergency situations. This guide offers a comprehensive overview of how to complete this form online, ensuring a smooth and accurate submission process.

Follow the steps to successfully complete the Form 1068 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating the type of submission by checking one of the boxes in Section 1. Choose between whole loans for first or second mortgages or the percentage sold to Fannie Mae for participation mortgages.

- Enter the lender loan ID in the designated field, ensuring it does not exceed 15 characters.

- Fill in the note rate in percentage format (XX.XXXX%) in the next field.

- Specify the original term of the loan in months in Section 26.

- Select the type of amortization in Section 2 by checking the appropriate box.

- Complete the relevant fields regarding the loan type in Section 3, checking FHA, VA, or Conventional as applicable.

- Fill out the detailed address information, including street name, city, state, and zip code, ensuring character limits are adhered to.

- Enter the unpaid principal balance and original loan amount in the specified formats.

- Once all fields are filled, review the document for accuracy. You can then save changes, download it, print, or share the completed form as needed.

For a seamless experience, complete your documents online with confidence.

Filling out a withholding exemption form requires careful attention to detail on Form 1068. Begin by ensuring all personal information is correct, and specify the reason for the exemption clearly. It's crucial to check your state's requirements, as they may vary. Using resources like U.S. Legal Forms can make completing this form easier and more efficient.

Fill Form 1068

Form 1068 is used when a person's name has been removed from the interest list for the Home and Community-based Services (HCS) Program. Organizations that are tax-exempt in California may be required to satisfy the filing requirements provided in this publication. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. Retirement Direct Deposit Authorization and Input Form. Code: CO-1068. Download. Title Form 1068, Withdrawal of Offer for Home and Community-based Services (HCS) ProgramES. Title Form 1069, Withdrawal of Offer of Texas Home Living ProgramES. To order current year forms, call . Select "Business Entity Information, then select. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.