Loading

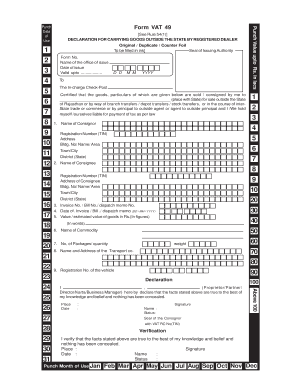

Get Mptaxmpgovin Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mptaxmpgovin Form online

Filling out the Mptaxmpgovin Form online is a straightforward process that ensures accurate declarations for carrying goods outside the state. This guide provides clear, step-by-step instructions tailored to assist users in completing the form effectively.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the Mptaxmpgovin Form and open it in your preferred editor.

- Begin by entering the name of the office that issued the form in the designated field. This is typically located at the top of the form.

- Input the date of issue in the format of DD/MM/YYYY, ensuring that the date is accurate and reflects when the form was issued.

- Fill in the 'Valid up to' section with the expiration date of the document, using the same date format.

- In the next section, provide the name and address of the consignor, including all relevant information such as district and state.

- Then, enter the name of the consignee along with their registration number and complete address.

- List the invoice number or dispatch memo number, making sure it corresponds to the transaction related to the goods being carried.

- Insert the date on the invoice or dispatch memo, again using the DD/MM/YYYY format.

- Outline the value or estimated value of the goods both in figures and in words to ensure clarity.

- Indicate the number of packages, quantity, and weight of the goods in the corresponding fields.

- Provide the registration number of the vehicle that will be used for transporting the goods.

- In the declaration section, affirm the truthfulness of the information provided by signing and entering your name, status, place, and date.

- After completing all fields, review the form for accuracy. Save your changes and download a copy for your records. You can also opt to print or share the form as required.

Begin filling out the Mptaxmpgovin Form online for your goods transportation today.

You can check property details online in Madhya Pradesh by accessing the Mptaxmpgovin Form portal. Enter the required property's unique identification information, which typically includes the district and relevant registration details. This service allows you to effortlessly explore critical information about property ownership and boundaries, making it easier for you to manage your real estate interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.